M2M Tech - Data Talent Program

Mission: upskill driven professionals with a passion for Data Science and Machine Learning, connect them with employers across various sectors across Canada.

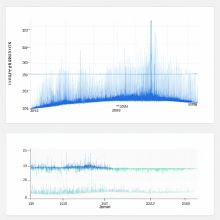

Portfolio Profiling Project Description: I developed a stock analysis tool that integrates financial metrics and interactive visualizations.

Data Collection:

I implemented functionality to download stock data and financial metrics for specified tickers using 'yfinance' and calculate yearly Sharpe ratios, designed a feature to calculate and visualize cumulative returns with interactive Plotly graphs, and created an interactive candlestick chart for each ticker with customizable time intervals.

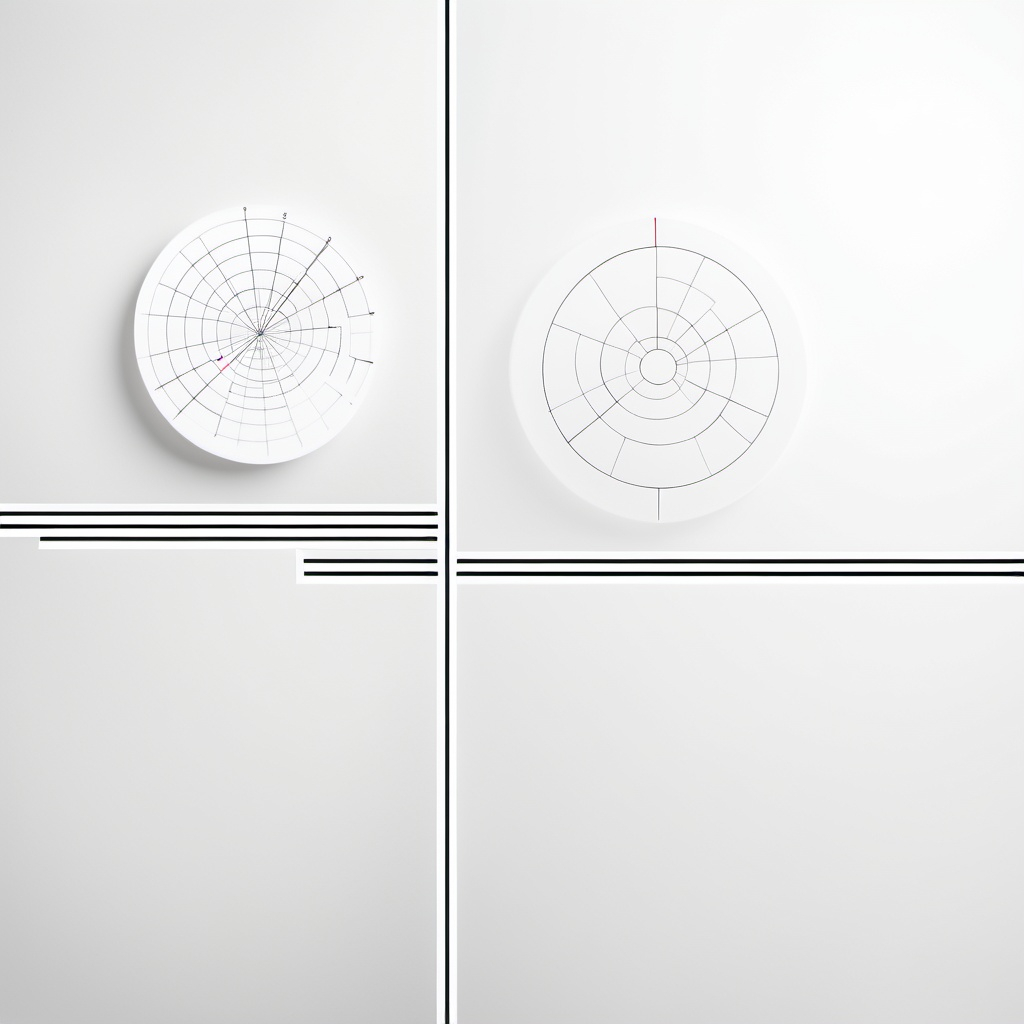

Visulazations

I developed a heatmap for exploratory data analysis (EDA) and performed statistical analysis of Sharpe ratios across various tickers and years, incorporated data handling techniques such as NaN management, Min-Max scaling, and the calculation of a decision score for each ticker based on value, growth, and profitability metrics, and designed an interactive investment donut chart to assist in portfolio decision-making based on the calculated decision score.

Optimizing Stock Trading Decisions

In today's fast-paced financial markets, making informed stock trading decisions is crucial for maximizing returns and minimizing risks. This project aims to enhance trading strategies by utilizing agent-based models and analyzing historical stock data. The goal is to predict optimal buy and sell actions for stocks, helping traders make better decisions.

Reasoning

Agent-based modeling simulates the actions and interactions of individual traders (agents) in the market. By incorporating historical data, we can create realistic trading scenarios that reflect past market behavior. Our project explores the performance of two different trading agents, each with unique strategies for making buy and sell decisions based on historical stock price movements. The strategies employed by the agents were designed to capitalize on market trends, reacting to price changes and volume data. By comparing the performance of these agents, we aim to identify which strategies yield the best results in terms of portfolio growth over time.

Results

Our analysis produced several key findings, which are visually represented in the project 1 code section above. Results demonstrate the effectiveness of the agents' strategies in managing a stock portfolio formed by 10 different firms. The results of our project indicate that agent-based models can significantly enhance stock trading strategies. By simulating various trading actions and analyzing historical data, we identified effective buy and sell strategies that lead to improved portfolio performance. These insights provide valuable guidance for traders looking to optimize their stock trading decisions in real-world markets.

Research Process

Flexible Agents